The UK’s new automobile finance suffered its “largest contraction” in new enterprise volumes since February 2021’s COVID-19 lockdown period throughout June, in accordance with new knowledge printed by the Finance and Leasing Affiliation (FLA).

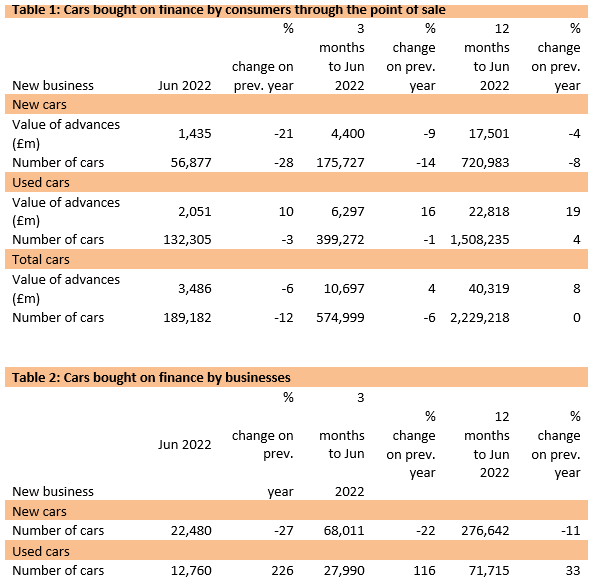

New enterprise volumes fell 12% year-on-year general within the final month of H1 2022 as the brand new automobile finance market’s new enterprise declined 21% by worth (to £ 1.44 billion) and 28% by quantity (to 56,877).

The affect of the automotive sector’s provide points look like mirrored in an progress within the worth of the brand new used automobile finance enterprise written in the identical month, as some shopper modified teir buying choices to keep away from prolonged lead occasions.

New used automobile finance enterprise grew 10% by worth (to £2.05bn) and declined simply 3% by quantity (to 132,305 items) in the identical interval.

Total, that meant that the worth of recent enterprise decreased by 6% (to £3.49bn) year-on-year in June as volumes declined 12% to 189,182.

Geraldine Kilkelly, the FLA’s director of analysis and chief economist, stated: “In June, the brand new automobile finance market reported its largest contraction in new enterprise volumes since February 2021 as automobile shortages continued to disrupt the market’s restoration.

“Against this, the enterprise used automobile finance market reported report month-to-month new enterprise volumes in June, and shopper used automobile finance new enterprise volumes have been solely barely decrease than in June 2021.”

Progress expectations

Regardless of the financial headwinds at the moment dealing with the UK, Kilkelly stated that finance suppliers nonetheless count on to ship progress over the approaching 12 months.

She stated: “Shopper spending is anticipated to weaken in the course of the second half of 2022 as incomes are squeezed by greater inflation, rates of interest, and taxes.

“Our Q3 2022 trade outlook survey suggests 56% of motor finance respondents count on progress in new enterprise over the following 12 months, down from 76% within the Q2 2022 survey.

“As at all times, clients who’re frightened about assembly funds ought to communicate to their lender as quickly as doable to discover a answer.”

Commenting on as we speak’s FLA knowledge, Michael Davidson, chief income officer at Freedom Finance, acknowledged that the automotive sector had struggled with extreme headwinds because the COVID-19 pandemic, with a scarcity of semi-conductor chips impacting provide for consumers within the UK and driving up the price of second-hand vehicles.

However he added: “Motor finance has an important function in enabling extra folks to purchase autos by spreading the price of funds.

“The market has seen important innovation to broaden the vary of merchandise which can be accessible to clients and there at the moment are extra bespoke, versatile choices that may swimsuit a buyer’s particular person circumstances.

“Many profitable automobile dealerships have additionally put in place embedded finance companions that may meet their clients’ calls for for fast, easy entry to a variety of various automobile finance choices in addition to different monetary companies, in order that their clients can get the very best deal at supply at any stage of the acquisition journey.”